Dave Says

Hold on for now

Dear Dave,

My husband was laid off a month ago from a job making $80,000 a year. We have no debt except our house payment. We owe about $82,000 on it, but it’s valued at approximately $300,000. We’ve also have an emergency fund of $30,000, and I work part-time making about $2,000 a month while he collects unemployment and looks for another job. Do you think we should sell our home? We’ve also got a boat that’s worth about $18,000 we could sell.

Sheila

Dear Sheila,

The first thing I want you to do is take a step back and breathe. Yes, you guys just hit a big bump in the road. But the good news is you’re in pretty good shape financially to handle things for a while.

At this point, I’d strongly recommend selling the boat over selling the house. Boats are a lot easier to replace than nice homes, and the process isn’t nearly as traumatic on the family. You can also dip into your emergency fund a little bit, but for the next little while you need to make sure you’re living on a really tight, bare-bones budget. I’d love to see you not have to touch the emergency fund, because he’s gone out and found at least a part-time position while he’s searching for something in his field. I know that’s tough to do once you’ve gotten used to making $80,000, but there are jobs out there that will help you guys get through this.

As long as he’s being diligent in seeking a new job, and you’re budgeting and watching what you spend together, I think for now you should keep the house. God bless you both!

—Dave

Refund or better planning?

Dear Dave,

Do you recommend having people keep their W2 numbers as close to their tax return numbers as possible, even if they might have to pay at the end of the year or have more taken out? Every year I get a big tax return. But after listening to you I began to think that if I did a better job of planning I would have more money throughout the year.

Charlie

Dear Charlie,

I like your thinking, and you’re absolutely right. That’s exactly what I recommend people do when it comes to their income taxes. Of course, you don’t want to have to pay out a big chunk of cash. But a little number crunching and planning can help you avoid those kinds of situations.

You really don’t want a big refund, and here’s why. If you get a fat tax refund every year, all it means is you’ve loaned money to the government interest-free for the entire year. Then, at the end of the year they gave it back to you. Some people seem to think Santa Claus has shown up when this happens, and that’s completely wrong. You’ve had too much taken out of your check every payday during the previous year, and then you got it back.

Try to adjust your W2 so that you are hitting within $100 or so at the end of the year. Then you’ll have more of your own money in your own pocket throughout the entire year.

—Dave

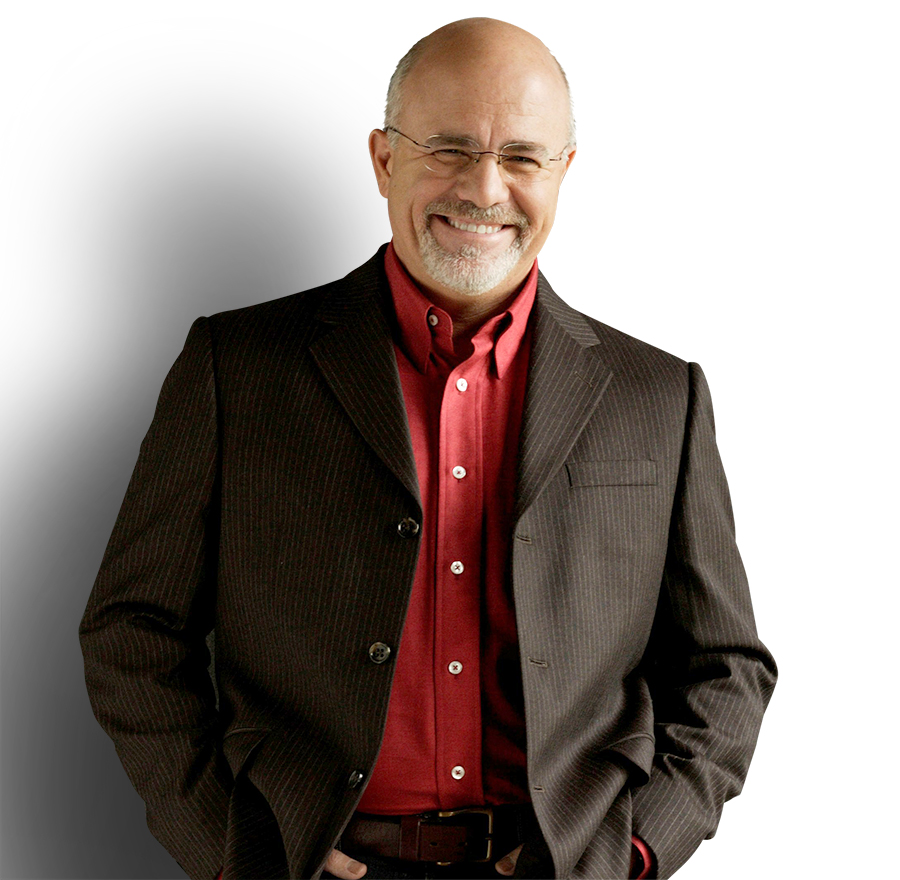

About the author

Dave Ramsey is America’s trusted voice on money and business, and CEO of Ramsey Solutions. He has authored five New York Times best-selling books. “The Dave Ramsey Show” is heard by more than 11 million listeners each week on more than 550 radio stations and digital outlets. Dave’s latest project, EveryDollar, provides a free online budget tool. Follow Dave on Twitter at @DaveRamsey and on the web at daveramsey.com.