The Buck Starts Here

PHOTOS: Fred Lopez

While children will learn plenty about reading, writing, and arithmetic, schools are neglectful by not teaching them how to be financially literate. Therefore, the responsibility is on parents to teach their children about matters related to money.

Parents also need to be good financial role models. Taking a weekend trip to Las Vegas instead of paying down credit card debt doesn’t exactly cut it. Conversely, paying bills on time and not running up a credit card will encourage kids to do the same when they’re adults.

There are things you can do as parents to help your kids achieve financial and personal responsibility.

PIGGY BANK 101

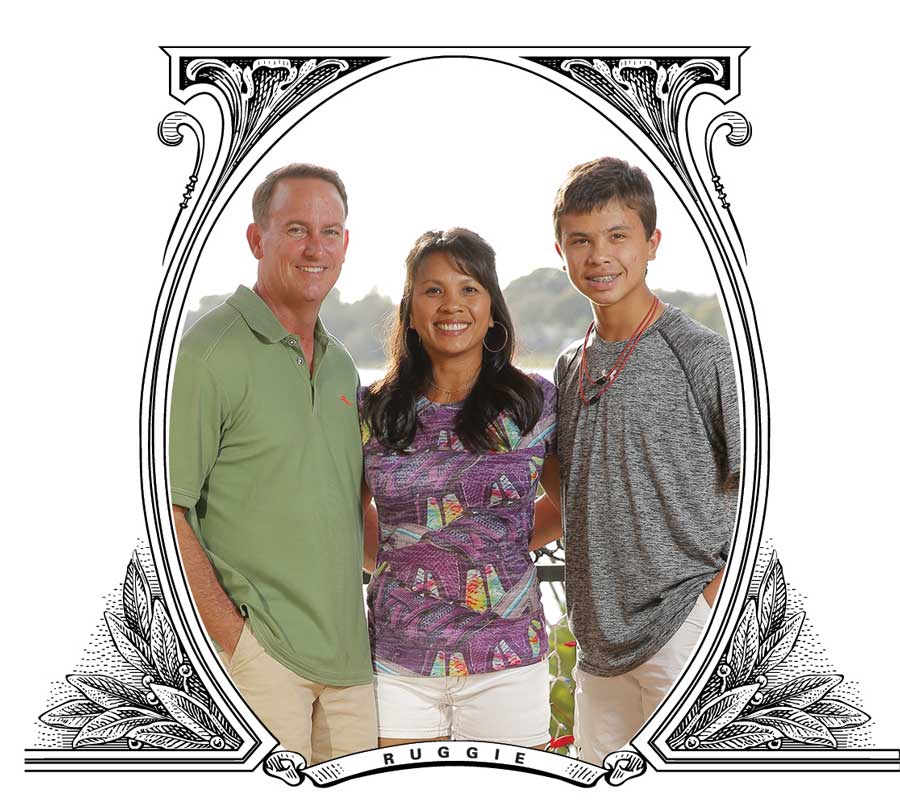

Tom Ruggie is owner of Ruggie Wealth Management in Tavares. Therfore, it’s no surprise that Tom, a chartered financial consultant (ChFC) and certified financial planner (CFP), taught his children to be financially savvy at a young age.

As a matter of fact, his daughter, Gina, and son, Christopher, began saving and investing at age 5. Fifty percent of their allowance or other money earned was put into a money market account. As the money market grew, Tom required them to put a portion of the money into stocks.

“I made a list of stocks they would be familiar with, such as McDonald’s and Walt Disney World,” he says. “I let them make the decision of which stock they wanted to invest in. Then I showed them how to make an Excel spreadsheet and track how their stocks were doing. People need to understand that sometimes they’re going to lose in the stock market. I wanted my children to realize that at an early age so they wouldn’t put blinders on and make emotional decisions.”

Those early financial lessons have certainly paid dividends for Gina, a 27-year-old University of Central Florida graduate who currently is employed as manager of operating participants at Walt Disney Parks and Resorts. She invests 30 percent of her net income and has never asked her father to borrow money.

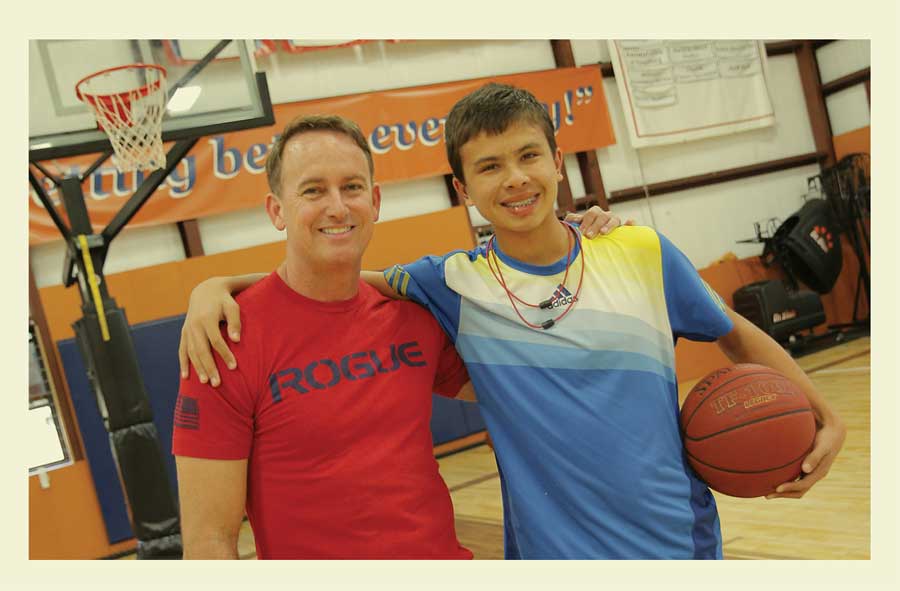

Christopher is now 14 and continues learning the finer points of managing money. He and Tom watch the reality show “Shark Tank” and read numerous business-related books together, including Dale Carnegie’s “How to Win Friends and Influence People.”

“Once an episode of ‘Shark Tank’ is over, I’ll ask him questions about some of the investment decisions made on the show to get his mind thinking,” Tom says, “and when we’re reading a book I make him write a summary to help me understand what he has learned.”

A FEW TIPS FROM TOM WHEN IT COMES TO CHILDREN AND FINANCE:

1. “Whenever my kids wanted to purchase something such as a game system, I rarely helped them financially. Instead, they had to save their own money because I wanted them to learn about the importance of setting goals at a young age. When children want something it’s not about immediate gratification; it needs to be goal-oriented.”

2.“The one time I did loan my children money I charged them $1 per week in interest. They never asked me for money again.”

3. “I also taught my kids about the importance of budgeting. Each year at Christmas I would give them $75 so they could buy gifts for other people. I had them write out who they needed to buy gifts for, what they were going to buy, and how much each gift cost. If they went over their budget they had to either eliminate someone from their list or use their own money.”

4. “I still include Christopher when it comes to family financial decisions. For instance, I recently moved into a new office and went shopping for desks. I wanted Christopher to see that you get what you pay for.”

THE DOS AND DON’TS OF ALLOWANCE

1. Don’t take away his or her allowance as a means of punishment, such as getting in trouble at home or school. Similarly, if a child performs a good deed, like helping the neighbor carry in groceries, don’t give your child extra allowance. A child may erroneously think that all acts of kindness should be rewarded.

2. Do verbally let your children know when they have done something good or bad.

3. Don’t over-manage their money.

4. Do use allowance to teach basic moneymaking skills and let them learn from their mistakes.

5. Don’t feel obligated to pay as much allowance as your neighbors and friends.

6. Do give them an allowance that is reasonable for your family’s financial situation.

7. Don’t question their purchases.

8. Do have them carefully track where they are spending their money. This way they can see how quickly money can be spent or how fast money accumulates through saving.

9. Don’t give kids an allowance regardless of whether they completed their chores or not. This will inevitably lessen the value of responsibility.

10. Do be consistent with paying allowance. Why should children hold up their end of the bargain when you cannot hold up yours?

TEACHING CHILDREN PERSONAL RESPONSIBILITY

There’s little surprise as to why today’s youth has been nicknamed the “Me First” generation. Sadly, advanced technology such as the Internet and cell phones have resulted in a generation of impatient youth who expect instant gratification. Parents are equally guilty by giving into the demands of their children and buying what they want when they want it. This results in a poor work ethic and a lack of gratitude. Why work for something when it will be given to you, and why be thankful when you always get what you want?

Fortunately, entitlement does not have to trump personal responsibility in your household. Here are some simple things you can do that will stop your child from waking up each morning and wondering, “What is everyone going to do for me today?”

START YOUNG

Waiting until your children are teenagers to begin assigning responsibilities is a mistake. If they’ve never had responsibilities before, they will not want to begin now. Teach them at a young age how to do simple tasks such as making a sandwich or making their bed.

ASK FOR THEIR HELP

Be enthusiastic—not grumpy—when you have to do housework. If you appear angry, then they’ll follow suit and view any task as tedious. Think of innovative ways to make chores fun so children feel a sense of togetherness.

DON’T GIVE THEM ANY AWARDS

Nobody should be rewarded because they’re responsible. Rewards should be saved for good report cards or good behavior.

LET THEM MAKE CHOICES

If the family is going to buy a new television set or planning a summer vacation, then let your children provide ideas and input into those decisions. This definitely gives them a sense of responsibility.

ENCOURAGE VOLUNTEERISM

This is a great way to let your child know the world does not revolve around him or her. Moreover, being involved in a worthy cause will teach the child to take responsibilities seriously and develop a wonderful sense of belonging.

TEACH CONSEQUENCES

If your child fails to complete assigned tasks such as mopping the floor or cleaning dishes, then some sort of punishment must be administered. This way, a child will learn to accept responsibility for his own actions rather than make excuses or assign blame to someone else.